Jumbo Loan: Competitive Rates and Flexible Terms for Pricey Characteristics

Jumbo Loan: Competitive Rates and Flexible Terms for Pricey Characteristics

Blog Article

Browsing the Jumbo Loan Landscape: Vital Insights for First-Time Homebuyers

Navigating the intricacies of big finances provides a distinct set of difficulties for new homebuyers, specifically in an evolving actual estate market. Understanding the necessary qualification requirements and prospective advantages, alongside the downsides, is critical for making educated decisions. In addition, creating a strong financial approach can considerably enhance your leads. Involving with specialists in the area can brighten pathways that might at first appear daunting. Yet, as you check out these complexities, it becomes clear that a much deeper understanding can expose opportunities that could otherwise be ignored. Just how can you finest placement yourself for success in this specialized segment of lending?

Recognizing Jumbo Finances

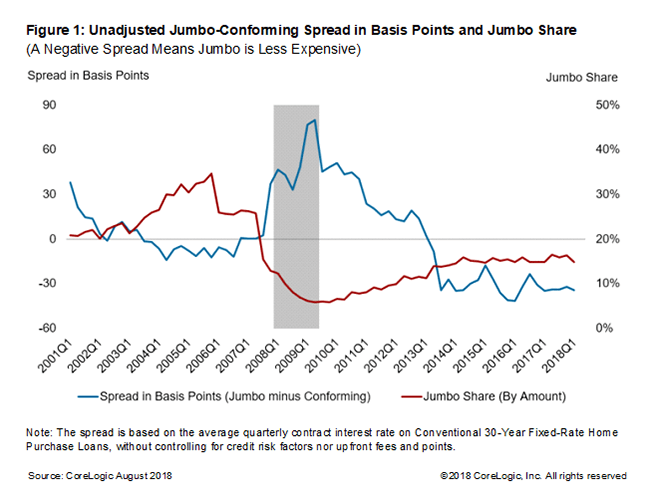

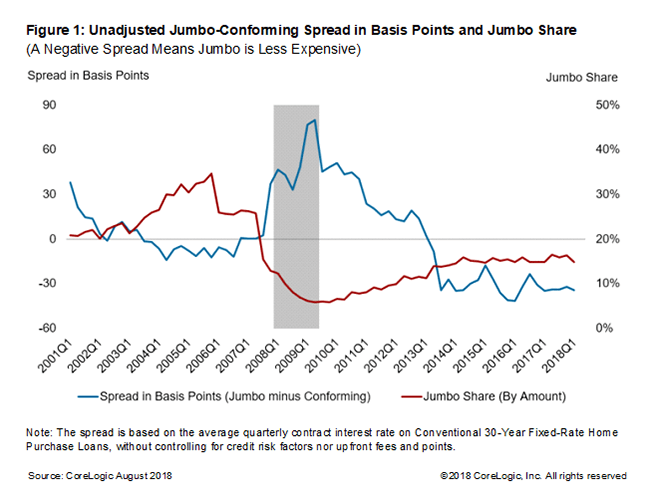

Because jumbo finances are not backed by government-sponsored entities, they carry different underwriting standards and call for more extensive financial documents. This difference can cause higher rates of interest contrasted to standard finances, provided the increased danger to lenders. Jumbo financings likewise supply one-of-a-kind benefits, such as the ability to fund higher-value buildings and possibly more adaptable terms.

Newbie buyers must also realize that securing a jumbo funding frequently demands a larger deposit, usually varying from 10% to 20%. Additionally, debtors are usually anticipated to demonstrate solid creditworthiness and a secure income to qualify. Comprehending these nuances can encourage novice buyers to make enlightened choices when discovering jumbo lending choices in their pursuit of homeownership.

Qualification Needs

Safeguarding a big funding needs meeting specific qualification demands that vary substantially from those of conventional lendings. Unlike traditional lendings, which are frequently backed by government-sponsored entities, big lendings are not guaranteed or assured, causing more stringent requirements.

One primary demand is a higher credit report. Lenders typically expect a minimal rating of 700, although some may allow reduced ratings under particular conditions (jumbo loan). Additionally, customers need to show a robust financial profile, which consists of a low debt-to-income (DTI) proportion, generally no greater than 43%. This makes sure that customers can manage their regular monthly repayments along with other financial obligations.

Moreover, most lending institutions need substantial documentation, including evidence of income, possession statements, and income tax return for the past 2 years. A considerable deposit is additionally important; while traditional finances may allow down payments as low as 3%, jumbo finances frequently demand a minimum of 20%, depending upon the financing and the lending institution quantity.

Advantages of Jumbo Fundings

For numerous novice buyers, big car loans use distinct advantages that can promote the trip toward homeownership. One of the main benefits is the capacity to finance residential properties that exceed the adhering loan limits set by government-sponsored entities. This versatility enables customers to access a broader range of high-value see this website homes in competitive realty markets.

In addition, jumbo car loans frequently feature attractive rate of interest that can be less than those of conventional lendings, particularly for debtors with solid credit profiles. This can cause significant cost savings over the life of the financing, making homeownership more budget-friendly. Additionally, big fundings commonly permit for higher car loan amounts without the requirement for private home mortgage insurance policy (PMI), which can better decrease general expenses and monthly settlements.

Prospective Downsides

Numerous possible homebuyers may find that big fundings come with substantial drawbacks that require careful factor to consider. Among the key issues is the stringent qualification requirements. Unlike adjusting finances, jumbo fundings normally need greater credit history, commonly going beyond 700, and significant revenue documents, making them less easily accessible for some consumers.

Additionally, jumbo financings usually come with greater rates of interest contrasted to standard finances, which can bring about increased regular monthly repayments and overall loaning prices. This premium may be particularly challenging for first-time property buyers that are currently navigating the economic intricacies of buying a home.

One more noteworthy drawback is the larger deposit requirement. Lots of lenders expect a minimum deposit of 20% or even more, which can posture an obstacle for customers with minimal savings. Furthermore, the lack of federal government support for big lendings brings about less desirable terms and conditions, increasing the risk for lenders and, consequently, the loaning prices for home owners.

Lastly, market changes can substantially influence the resale worth of premium residential properties financed with big car loans, including a component of monetary changability that novice buyers might discover daunting.

Tips for First-Time Homebuyers

Browsing the complexities of the homebuying process can be overwhelming for new purchasers, particularly when taking into consideration big fundings (jumbo loan). To simplify this journey, sticking to some key techniques can make a considerable difference

First, inform on your own on big financings and their specific demands. Understand the different loaning standards, including credit report, debt-to-income proportions, and deposit assumptions. Commonly, a minimal credit rating of 700 and a down repayment of a minimum of 20% are necessary for authorization.

2nd, involve with a well-informed home mortgage Continue specialist. They can supply understandings customized to your monetary circumstance and help you browse the details of the big loan landscape.

Third, consider pre-approval to enhance your acquiring placement. A pre-approval letter signals to vendors that you are a significant buyer, which can be useful in open markets.

Lastly, do not neglect the relevance of budgeting. Consider all costs related to homeownership, including real estate tax, maintenance, and house owners' insurance. By adhering to these suggestions, newbie buyers can come close to the big financing procedure with better confidence and clarity, enhancing their possibilities of effective homeownership.

Conclusion

To conclude, browsing the big financing landscape calls for a detailed understanding of qualification criteria, benefits, and possible drawbacks. Novice buyers can improve their possibilities of success by keeping a strong credit history, managing their debt-to-income ratio, and preparing for bigger down payments. Engaging with experienced home loan experts and obtaining pre-approval can even more strengthen positions in open markets. Inevitably, detailed preparation and education relating to big car loans can bring about even more educated decision-making in the homebuying process.

When browsing the complexities of the housing market, understanding jumbo fundings is essential for newbie property buyers aiming for homes that go beyond standard loan restrictions. Jumbo car loans are non-conforming financings that generally exceed the adapting funding limitation established by the Federal Real Estate Money Agency (FHFA)In addition, jumbo lendings commonly come with eye-catching rate of interest rates that can be lower than those of traditional lendings, specifically for customers with solid credit report accounts. Big car loans usually enable for greater finance quantities without the demand for private mortgage insurance coverage (PMI), which can better minimize month-to-month payments and general expenses.

Unlike conforming lendings, jumbo car loans typically need higher credit rating ratings, usually surpassing 700, and substantial income documentation, making them less easily accessible for some consumers.

Report this page